Having Debt Is Hard. Eliminating Debt Is Easy.

One Affordable Monthly Payment

Consolidate and reduce your minimum payments into one, low monthly payment that fits your budget.

5 Simple Steps

1. Free Consultation

2. Monthly Deposits

3. Debt Negotiation

4. Settlements

5. Become Debt-Free

Resolve Your Debt in 20-48 Months

With our expert team of negotiators, we can help you become debt-free faster than you ever thought possible!

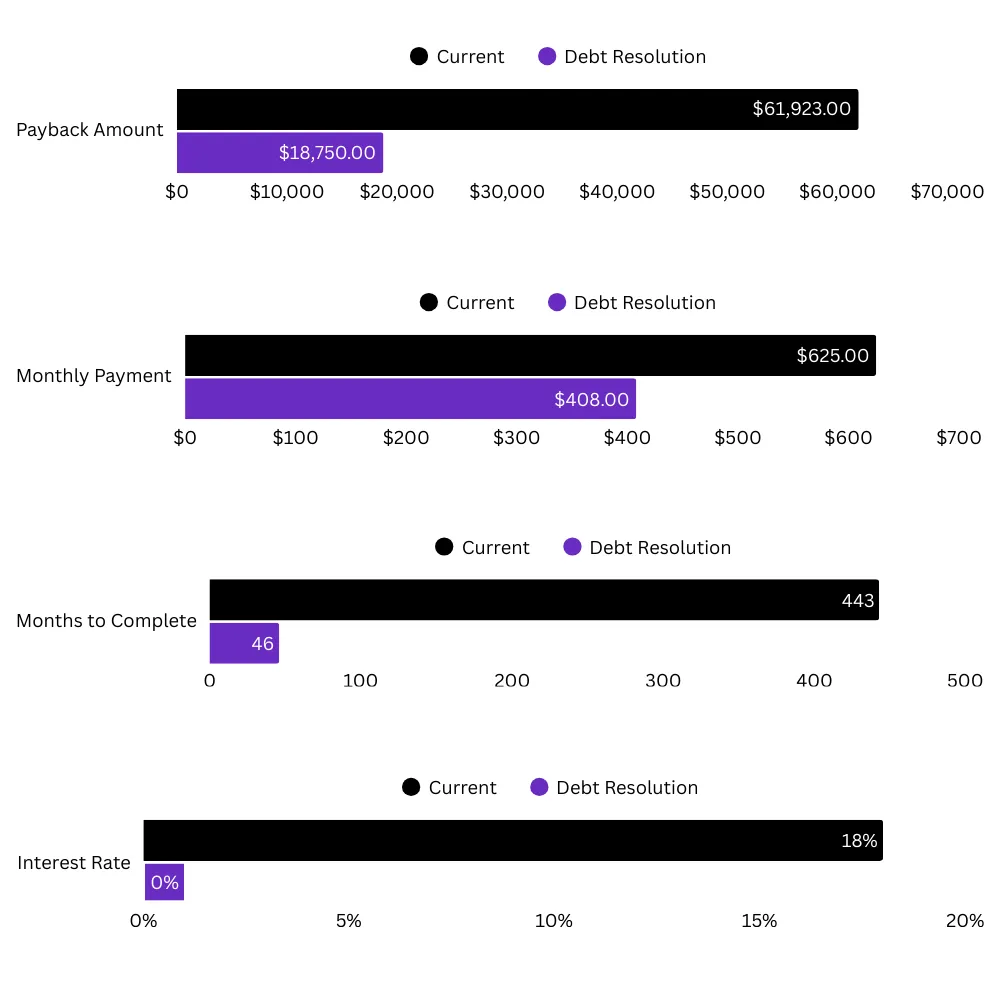

Debt Resolution vs. Current Monthly Payments

If you had $25,000 in credit card debt, were charged 18% interest, & paid only the minimum each month ($625), it would take 443 months (36 years!) to pay off, & cost you $36,923 in interest!

With our program, you could pay it off in less than 48 months, & only pay $18,750. Plus, save over $200 each month!

Debt We Can Help With

Our comprehensive debt resolution programs can help you with the following types of unsecured debts – debt that is not backed by collateral such as a house or car.

Creditors, Banks, and Delinquencies

Credit Card Debt

Payday Loans

Medical Debt

Private Student Loans

Personal Loans

Lines of Credit

Personal Business Debts

Collections, Judgements, and Deficiencies

Plus Many More!

Get Approved Now

Your Path to Financial Relief Starts Here

You could be just a few steps away from your custom debt relief plan.

Our quick survey helps us understand your unique financial situation so we can match you with the best debt relief option — whether it’s consolidation, settlement, or credit card relief.

💡 No credit check required to get started.

✅ Takes less than 60 seconds

🔒 Secure & confidential — your info is always protected

See What Our Customers Say

Due to unexpected expenses and a sudden increases in the cost of living, many people find themselves continuing to borrow money to cover costs.

Being on a fixed income and consistently struggling to make ends meet, only causes them to dive deeper and deeper into debt.

This is where we step in, by turning to Accredited Solutions, we help our clients to save money and become debt-free faster.

Kim Welsch

I was drowning in credit card debt and didn’t know where to turn. Their team was kind, professional, and extremely knowledgeable. They explained every step of the process clearly, and within a few months, I started seeing real progress. I’m finally on track to becoming debt-free, and I couldn’t have done it without them!

Gregory Jackson

Accredited Solutions worked with my creditors and negotiated settlements that saved me thousands. Their communication was consistent and transparent throughout the process. I’ve recommended them to three colleagues already. Outstanding service!

DISCLAIMER: Debt Consolidation Program (“Program”) also known as Debt Relief or Debt Settlement serviced thru Accredited Solutions LLC refers to clients who have enrolled in a Program with Accredited Solutions LLC. Whereas Accredited Solutions LLC shall work aggressively to negotiate the Program Debt, not all debts can be negotiated and not all creditors negotiate. Individual Program results may vary and are based on but not limited to the ability of clients to save funds and successfully complete their Program terms and conditions, the amount and type of debts and creditors, history of accounts and financial standing of clients. Any specific or general reference to “debt free”, “savings”, “eliminate” or “reduce” debts only refers to clients that have successfully enrolled and completed their Program resulting in all Program Debt being settled for less than the original balance enrolled. Any figures given or statements made are examples of past performances and are not intended to guarantee future results and Accredited Solutions LLC does not guarantee that debts successfully enrolled in the Program will be settled, lowered by a specific amount or percentage, settled in a specific time period or that clients will be “debt free” in a specific time period. All Program terms and conditions are subject to change without notice and not all applicants are approved. The Program is not available in all states and other restrictions apply. Read and understand all Program materials prior to enrollment, including potential adverse impact on credit rating. Accredited Solutions LLC is not a law firm and does not provide any legal, bankruptcy, tax or accounting advice or credit repair services and anyone considering bankruptcy should consult a bankruptcy attorney. Please contact a tax professional to discuss potential tax consequences of the Program. Depending on your state, we may be able to recommend a Bankruptcy attorney. Depending on your state, we may be able to refer you to our lending partners for a Debt Consolidation Loan. Annual Percentage Rates provided by our lending partners range from 5.99% to 35.89%. Please note that calls with the company may be recorded for quality assurance.

*Minimum requirements to qualify

Minimum of $10,000 total Credit Card Debt

The ability to afford a minimum monthly payment of 1.5% of the Total Credit Card Debt owed or $250 whichever is greater.